Market update: finance into funds

Reflecting on hiring trends and data in the job market for H1 of 2024, several clear trends emerge.

Some are positive, some give pause for thought, but all are insightful. A few indicators offer insight into what to expect from H2 2024 and perhaps even the job market in 2025.

First and foremost, where have he we seen hiring trends increase/decrease at varying levels? overall hiring and new vacancies in 2024 remained about stagnant with levels of 2023 and some way off the pace set by 2022.

At the CFO level and the CFO-1 level (Finance Director) there was a 4% increase in new mandates from the same period in 2023 but this is still nearly 40% behind the rates we saw in the same period of 2022.

What we have seen though is a more steady increase in senior management hires as CFOs look to ensure that if they can’t grow their teams at any pace, they need to ensure that the senior leadership is steadfast and performing.

We have noticed a particular need in the senior commercial finance space for Directors of Finance Business Partnering and Heads of FP&A, the demand for these roles has gone up 22%.

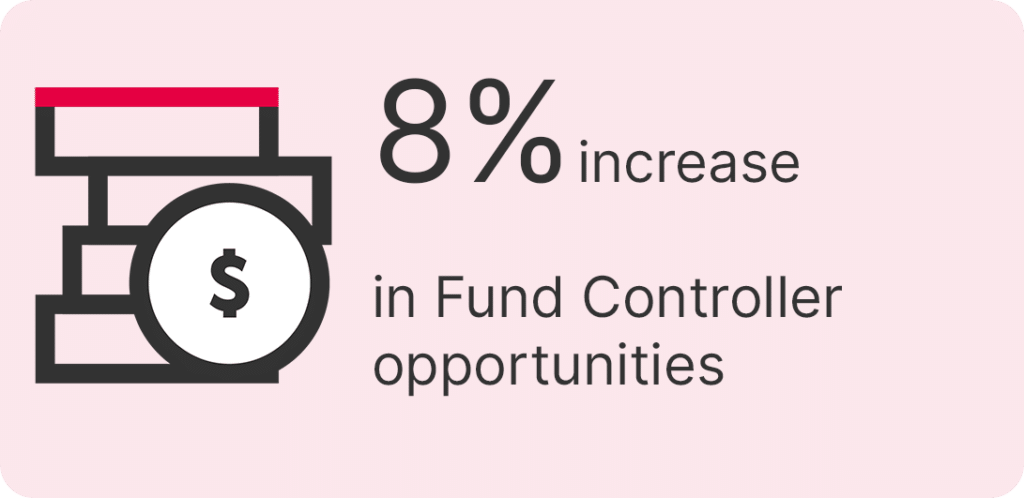

We have also noticed that fund finance roles at the more senior level have

remained robust. We saw an 8% increase in mandates for Fund Controllers.

The trend we have seen in increased need at the senior management level is often a good precursor to what we will see at the CFO level, so it’s fair to say we will likely see an increased demand at the CFO and FD level in H2 of this year and more likely and more noticeable increase throughout 2025.

This should combine well with a return to privateequity deal activity and the two things aren’t mutually exclusive.

The trends coming out of conversations with CFOs at PE and VC funds is that there are liquid funds ready to be deployed but companies are waiting for what they feel is the right time. Continuing uncertainty around interest rates has delayed a return to deal activity but investors are becoming increasingly impatient to know what is being done with the funds they have committed

to these funds. The whole employment market will benefit from this return to PE/VC activity as when acquisitions are made, there will inevitably be reshuffles

within finance in the portfolio companies. This will stimulate the wider market as companies will need and want to replace the talent that has been attracted to

these PortCos. All of the preconditions seem to be in place for a return to deal activity, all that’s needed now is the spark. This tends to come in the form of deals being announced by some of the big PE houses which is a catalyst for other PE firms feeling they may get good value for balance sheets at the moment, so the time is right to strike.

In terms of specific industries within the funds space there are a few interesting trends we have seen. One of the more concerning statistics is from the VC space, where hiring in finance across all levels and disciplines has been down by nearly 40% even from 2023. We have also seen reduced hiring in infrastructure which is down 8% from 2023.

Private equity hiring remains mostly stagnant. Large and small PE firms have reduced hiring in finance, while midsize firms have slightly increased hiring to balance this. Credit funds have increased hiring significantly, which is surprising.

We have seen a 20% increase in hiring for fund finance at the Fund Controller and Manager level across credit, debt,

direct lending focused funds.

If we are correct to predict that we will see an increase in hiring at the CFO level what will be interesting to see is exactly what sort of CFOs are in demand.

Companies recognise the importance of hiring a strong CFO, though the role varies by firm. CFOs with capital markets experience and skills in raising debt and equity are in high demand. Likewise, there is a need for CFOs who excel in building and maintaining control functions. Additionally, CFOs who can manage controls while acting as strategic partners to CEOs, COOs, and founders are especially sought after by smaller and boutique firms.

Download our full document to view our salary breakdown for fund, account and commercial finance below.

If you’re thinking about hiring for a new finance role, please get in touch below to submit a vacancy.